AI Hiring

11.21.2025

FinServ Contractor & IT Service Provider Trends for the AI-Enabled Enterprise

The Karat Team

AI is transforming the financial services (FinServ) industry, from trading to digital banking and fraud detection. As demand for digital innovation increases, FinServ organizations are increasingly relying on contractors and IT Service Providers (ITSPs) to deliver rapid progress while minimizing risk. Their expectations are rising at the same time, as engineering teams need to meet quality, security, AI-readiness, and regulatory compliance standards.

These dynamics are shaping new banking, financial services, and insurance (BFSI) tech talent trends. If FinServ leaders want to achieve their goals, they need to rethink how they evaluate both full-time hires and contract placements.

Trend #1: Shift to Contractors & IT Service Providers to Meet Speed and Compliance Pressures

FinServ engineering teams are increasingly hybrid, consisting of full-time employees, offshore or nearshore centers, and on-demand contractors. This shift is being driven by:

- Market volatility: Tariffs, geopolitical tensions, high inflation, signs of an impending recession, and long-lasting effects of the pandemic have created significant uncertainty.

- Cost efficiency: Despite efforts to cut costs over the last several years, many U.S. financial services firms have seen either flat or worsening cost-to-income and expense ratios. Outsourcing is a popular way to cut costs, as organizations have the flexibility to increase or decrease their workforce as demand and markets change. The data shows that only outsourcing 8% to 34% of IT work provides the right balance between investment and operations.

- Faster scaling for large transformation programs: Digital transformation remains a priority for FinServ companies, as a means to prevent fraud, improve productivity, fuel growth, reduce costs, ensure compliance, and meet customers’ expectations. However, only 30% of companies currently meet their timeline, budget, and scope expectations when implementing large-scale tech programs. One of the most significant pain points preventing success is the availability of required IT roles or skills.

For these reasons, IT service provider hiring by financial services organizations is increasing and how leaders work with ITSP engineers is evolving. ITSPs have become strategic, long-term partners rather than temporary overflow resources. However, this model also introduces several challenges:

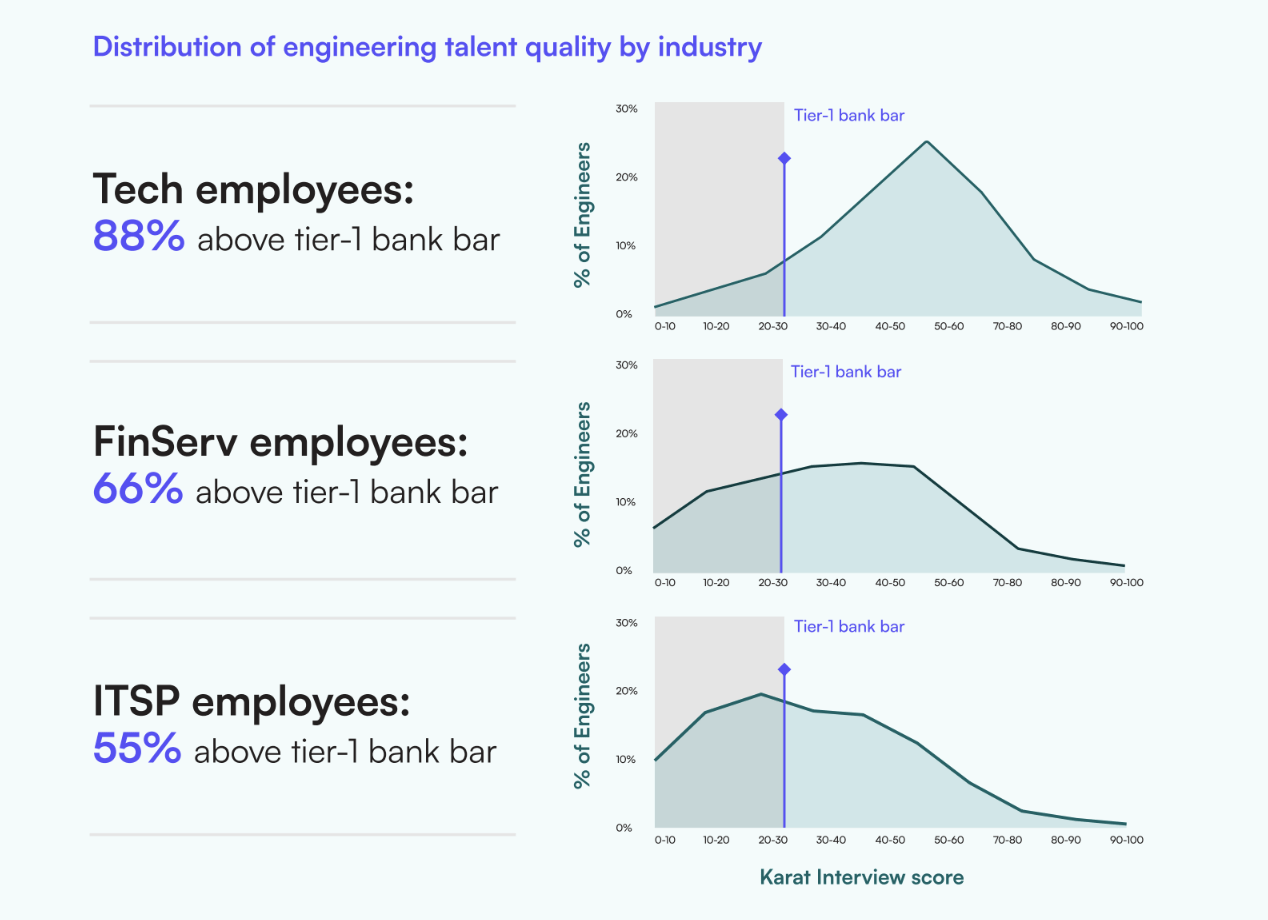

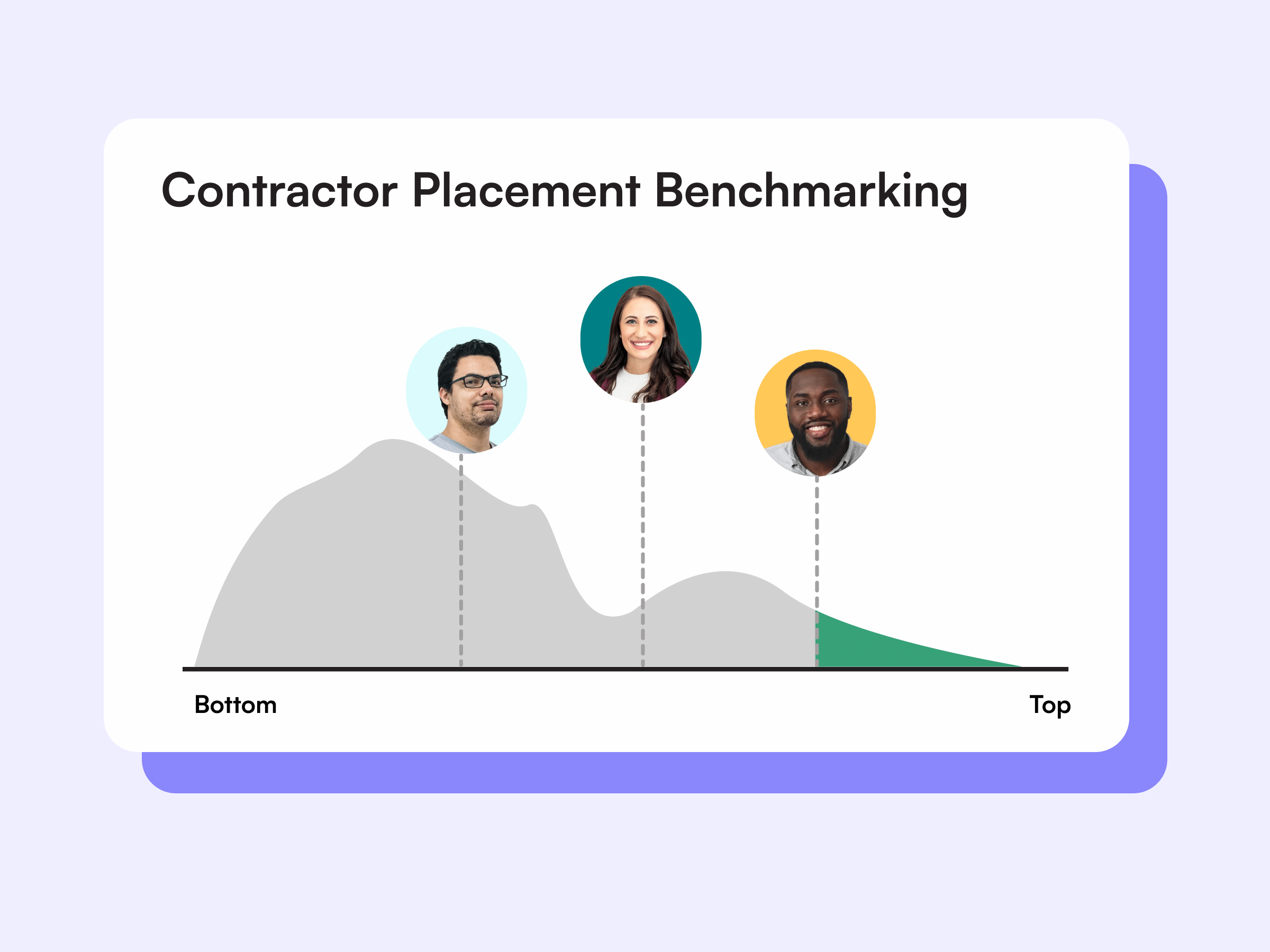

- Consistency: Many ITSPs lack consistent technical standards for who gets placed. As a result, FinServ organizations end up with engineers that don’t meet their technical bar for big banks. Our data shows that ITSP contractor quality often lags other markets, including tech and financial services. This inconsistency in talent quality makes it difficult for organizations to compete and scale their digital transformation programs.

- Skills mismatch: Digital transformation programs and financial services can require highly specialized skills and engineers. ITSPs that are strong in one area may not have candidates that fit the profiles in others, leading to mismatches between what the organization needs now and what service providers can actually staff.

- Variable code quality: FinServ companies often see different levels of code quality across contractors and ITSPs. This increases rework, introduces bugs or vulnerabilities, or leads to non-compliance.

- Offshore/nearshore variance: Some global service providers operate with different hiring standards and resourcing models in different markets. Nearshore outsourcing offers better real-time collaboration and easier oversight, while offshore setups can provide greater cost savings. However, it’s usually more challenging to maintain quality control, compliance, and effective communication. Global Capability Centers (GCCs) have also exploded, as companies have launched full-time tech hubs across India and Asia.

Trend #2: AI Is Redefining What “Engineering Quality” Means in FinServ

With the rapid adoption of AI coding assistants, code tests are no longer effective in measuring an engineer’s true technical skill. AI coding assistants can output correct, working code in seconds, inflating an engineer’s performance.

For FinServ companies, this is risky.

- AI-generated vulnerabilities can slip through. AI-generated code is the top concern for security and IT leaders, as the lack of transparency into third-party AI models can introduce unknown vulnerabilities. This can lead to data breaches, malware infections, and reputational damage.

- Code interpretability is a growing concern for sensitive industries that require accountability. “Interpretability in LLMs is essential for understanding their output generation and decision making, which helps to build trust, debug, and identify biases.” When engineers can’t understand how a model arrived at its output, debugging becomes difficult.

- Inconsistent talent quality across service providers is magnified with AI. When strong engineers use AI, they create disproportionate value, widening the gap between strong and weak engineers.

- Compliance exposure increases if contractors misuse AI tools. For example, they might use unapproved or insecure tools, or use these tools through their personal accounts. Unauthorized use or misuse can expose sensitive data. In fact, it’s already happened. Samsung banned the use of AI tools after employees accidentally leaked sensitive data in public prompts.

FinServ organizations need AI-ready engineers who can responsibly use AI to enhance their productivity, rather than blindly rely on it.

Trend #3: Contractor Talent Quality Is Becoming a Differentiator, Not a Commodity

Banks have historically seen contractors as interchangeable, but that’s no longer true. The value of strong engineers has steadily increased over the last few years. Now it’s seen a higher increase due to AI, which has proven to be a force multiplier rather than an equalizer. Nearly three-quarters (73%) of tech leaders say strong engineers are worth at least 3x their total compensation, while 59% say weak engineers deliver net zero or negative value.

Engineers who have a strong foundation and know how to leverage AI can become extraordinarily productive when using AI tools. But engineers without the right skills and knowledge will produce code that looks functional but may include hidden vulnerabilities and risks.

When evaluating ITSPs, the top partners should be able to demonstrate a higher concentration of strong engineers. This creates a more reliable workforce and accelerates the speed to securing placements. CIOs and VPs of Engineering are also looking at the following when choosing which providers to partner with:

- Consistency in engineering fundamentals: FinServ companies need assurance that a partner can reliably provide engineers who meet a baseline of technical ability. This ensures that the delivered work is consistent in quality, which is particularly important since contractors often work on some of the most important and strategic initiatives such as regulatory and digital transformation projects.

- Ability to detect AI-generated cheating in interviews: With the widespread use of AI tools, it’s easier than ever for engineers to make it seem like they have the necessary skills. Karat’s interview integrity checks are detecting a growing use of AI by candidates, with contract engineers exhibiting higher AI-useage rates than candidates for full-time positions. Organizations should have robust practices in place to identify and prevent engineers from using AI to cheat, preventing unqualified or misrepresented talent from joining their talent pool in the first place.

- Upskilling and governance practices: When partners are invested in and have programs to improve contractor quality, FinServ organizations can feel confident that contractors will remain up-to-date on new tech innovations and deliver secure, compliant work.

- Speed of onboarding and ramp time: Service providers that staff roles quickly and get engineers ramped up with minimal friction can help organizations reach their goals faster, reducing delays and keeping costs down.

With the widening gap between strong and weak engineers and the increasing expectations that FinServ companies have, talent quality has now become a part of service provider governance conversations. It’s no longer enough for ITSPs to simply fill open roles as fast as possible. They also have to show potential clients how they source, assess, upskill, and manage their talent.

Trend #4: New Skills Are Emerging as Must-Haves for FinServ Engineers

The impact of AI in FinServ engineering hiring can also be seen in the skills that are now considered to be most important. Our data shows that the top five engineering skills are all related to AI:

- Familiarity with agentic AI: Engineers must understand and be able to work with AI agents. For example, knowing how to design, deploy, and supervise AI agents to review code or run tests.

- Using AI for coding: This goes beyond simply using AI tools to generate code. Strong engineers know how to leverage AI tools to automate repetitive tasks, accelerate development, and streamline debugging while also maintaining code quality and security.

- Integrating third-party AI APIs: FinServ companies are incorporating AI capabilities from external providers as financial services and products, such as banking, Know Your Customer (KYC) automation, and credit decisioning, become AI-driven. Engineers should know how to integrate these tools securely, manage them, and make sure they comply with internal and external standards.

- Prompt engineering: AI is becoming embedded in engineering workflows. To generate accurate, useful, and safe AI outputs, engineers need to master the art of crafting effective prompts.

- Evaluating and mitigating AI-related risks: AI models can fail, hallucinate, and produce non-compliant outputs, which is why it’s important that engineers know how to recognize flaws in AI-generated code and design safeguards.

FinServ companies should make sure that a partner’s talent pool has these skills. For service providers, it means demonstrating that their engineers can operate in AI-augmented workflows while also meeting risk, compliance, and security standards.

Trend #5: Compliance, Fairness, and Auditability Are Now Core to Talent Decisions

Financial services and hiring are undergoing a dramatic transformation due to AI, and FinServ companies are facing intense growth and regulatory pressures. These forces have had a downstream effect on what FinServ leaders prioritize when evaluating talent:

- Repeatable, unbiased evaluations: To ensure high-quality talent across full-time employees and contractors, financial institutions are adopting standardized technical assessments that remove bias and consistently produce accurate hiring signals.

- Evidence that contractor hires meet internal controls: Contractors are now being held to the same standards as full-time employees. Partners that can prove how their contractors meet these requirements lower a client’s risk.

- Documented assessment processes for audits: Thorough documentation on the roles and responsibilities of engineers and how they were evaluated helps organizations prove that hiring decisions were made in accordance with internal controls and regulatory requirements.

- Safeguards against AI-related cheating: Cheating has taken on a new form with the rise of AI tools. Candidates can easily use AI to generate code or answers in minutes, making it critical for FinServ companies to adopt safeguards that detect and prevent the unauthorized use of AI in interviews.

- Interviewing processes that scale globally across IT service partners: Most FinServ organizations rely on multiple ITSPs. Scalable interview processes ensure that no matter where an engineer is sourced, they’re evaluated in the same way and meet the same hiring bar.

How FinServ Leaders Are Modernizing Their Contractor Strategies

Forward-thinking FinServ leaders are already changing how they assess and hire engineering contractors, paving the way for effective practices that will become the norm.

- Use human + AI interview formats to measure AI-ready engineering skills. Human-conducted interviews that allow candidates to use AI allow organizations to determine whether candidates can actually collaborate in an AI-enabled enterprise. This is incredibly important in a world where AI tools are becoming a core part of engineering workflows as well as financial services and products.

- Replace generic code tests with adaptive, live technical interviews. While allowing candidates to use AI in interviews helps you assess their AI skills, there’s also a downside. Candidates may use AI tools to cheat, and code tests are particularly susceptible to cheating because they rely on simply giving the right answer. Live interviews make it harder for candidates to cheat undetected, since interviewers can facilitate discussions, probe further, and spot potential signs of cheating.

- Apply consistent rubrics across full-time and contractor pipelines. Your hiring bar shouldn’t be different for full-time employees versus contractors. Using the same evaluation criteria for all candidates improves fairness, reduces bias, and ensures talent quality.

- Integrate interview data across partners for better quality control. By centralizing contractor performance data from all your ITSPs, you’ll be able to objectively compare partners, identify quality gaps, and enforce your hiring bar. With these data-driven insights, you can then allocate work to partners who perform the best.

- Speed up contractor onboarding with standardized assessments. Instead of applying custom evaluations to every new service provider or contractor, standardizing interviews speeds up the hiring process so that you can get qualified candidates up and running fast.

- Create baseline skill benchmarks across all IT service partners. Instead of accepting each provider’s internal standards, establishing your own benchmarks ensures every partner meets your standards of engineering quality. This gives FinServ leaders confidence that no matter where talent comes from, it will be consistent and meet your requirements.

What This Means for IT Service Providers & Contractors

As financial institutions raise their bar for engineering talent, ITSPs and contractors face a new hiring landscape. Proof of talent quality and relevant skills matter more than just cost and capacity. If they want to stay competitive, they must evolve to meet these requirements.

- Providers that invest in AI-readiness will outcompete others. Although 70% of banking institutions are already using agentic AI, most are struggling to find the right talent to support it. A lack of tech skills and capabilities is the second-most common challenge these organizations face. In the age of AI, partners with AI-ready engineering talent have a competitive edge.

- Contractor engineers need ongoing upskilling and proven competence. AI requires 80% of the engineering workforce to upskill. ITSPs that provide continuous training to their talent pool and contractors who can adapt to new tools and technologies are better positioned to be long-term partners.

- Partners that offer verifiable interview data will win more RFPs. IT Service Providers who can provide objective evidence of engineer quality have a significant advantage. Concrete data not only shows that contractors have been rigorously and fairly evaluated, but it also gives clients confidence that contractors meet their requirements.

- Quality, consistency, and fairness become differentiators in bid cycles. When providers have similar pricing, what separates them comes down to being able to consistently deliver high-quality talent. As FinServ organizations face a volatile market and ambitious digital transformation initiatives, service providers with a track record of maintaining engineering quality at scale help companies reduce their risk.

- Banks increasingly ask for proof of engineering excellence — not just rate cards. Decisions are no longer just driven by price. Financial institutions want evidence of a partner’s talent quality. Those who can provide data-backed records of engineering performance and skill assessments will earn trust and have an easier time closing deals.

Conclusion: The FinServ Talent Playbook Is Being Rewritten

These FinServ engineering hiring trends reflect how AI is raising the bar for engineering capability, security, and responsibility. As engineering workflows and financial services and products become increasingly AI-augmented, FinServ leaders can no longer rely on outdated assessments or uneven processes. Continuing to do so is risky and will further increase talent gaps.

Instead, the winners in this new landscape will be:

- FinServ organizations that modernize how they evaluate all talent, including full-time employees and contractors. By using standardized assessments, human + AI interview formats, scalable processes, and data, they’ll be able to quickly grow their engineering teams while maintaining a high technical bar.

- Partners who can prove quality, consistency, and AI-readiness at scale. ITSPs that invest in data-driven assessments and ongoing upskilling are most equipped to meet client expectations and requirements. They’ll be able to show the quality of their talent pool, helping them stand out in RFPs and build long-term partnerships.

These two groups will set the new standard for engineering excellence in financial services. If you’re ready to move toward this future, contact us to learn more about modernizing your hiring process with Karat’s Partner Talent Solution.

Related Content

AI Hiring

02.24.2026

AI-driven legacy modernization is quickly becoming a priority for financial services CIOs, but contractor governance frameworks have not kept pace. This week, two announcements signaled a structural shift for financial services technology leaders. Anthropic released a COBOL modernization playbook to accelerate mainframe transformation. At the same time, OpenAI unveiled its Frontier Alliances program with global […]

Global Hiring

02.03.2026

For modern CTOs and senior engineering executives, the mandate for Global Capability Centers (GCCs) has shifted. As noted in EY’s analysis of the sector, GCCs are no longer just cost-arbitrage plays; they are evolving into “AI-native enterprises” that lead global innovation. However, the transition from a skeletal satellite office to a high-performing innovation hub is […]

Contractor Hiring

01.28.2026

For most financial services organizations, software contractors aren’t optional. Whether it’s modernizing core systems, accelerating digital initiatives, or scaling delivery capacity, CIOs rely on IT Service Providers (ITSPs) to keep projects moving. But as many leaders have learned the hard way, contractor quality often fails to meet expectations. Last summer, Karat launched the first Partner […]